vehicle personal property tax richmond va

Personal Property Taxes are billed once a year with a December 5 th due date. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

2207 Lundie Ln Richmond Va 23231 Realtor Com

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

. Use our website send an email or call us weekdays from 8AM to 430PM. We are open for walk-in traffic weekdays 8AM to 430PM. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

Is more than 50 of the vehicles annual mileage used as a business. You can make Personal Property and Real Estate Tax payments by phone. 295 with a minimum of 100.

101KB Personal Property Tax Relief Act of 1998. If you have questions about your personal property bill or. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

The personal property tax is calculated by multiplying the assessed value by the tax rate. All property is taxable based on ownership. Personal Property Tax.

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer.

Young Tarry Division Director. Personal Property Registration Form An ANNUAL. Boats trailers and airplanes are not prorated.

The current rate is 350 per 100 of assessed value. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Real Estate and Personal Property Taxes Online Payment.

If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. Broad Street Richmond VA 23219. There is a convenience fee for these transactions.

It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. Electronic Check ACHEFT 095. On Tuesday the council voted.

At the calculated PPTRA rate of 30 you would be required to pay. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555. If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit.

The personal property tax rate is determined annually by the City Council and recorded in the budget appropriation ordinance each year. If your vehicle is valued at 18030 the total tax would be 667. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

You have the option to pay by credit card or electronic check. For Arlington County residents. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at. Monday - Friday 8am - 5pm. An example provided by the City of Richmond goes like this.

1Applying an 88 assessment ratio so that vehicle personal property tax bills will be based on 88 of a vehicles value in CY 2022 offsetting much of the increase that taxpayers would have experienced if. All cities and counties in Virginia have a personal property tax which helps fund local government. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments.

703-222-8234 TTY 711.

1203 Laburnum Park Blvd Richmond Va 23227 Realtor Com

2426 Hungary Rd Richmond Va 23228 Realtor Com

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

2207 Lundie Ln Richmond Va 23231 Realtor Com

2022 Subaru Legacy For Sale In Richmond Va Hyman Bros Automobiles

2207 Lundie Ln Richmond Va 23231 Realtor Com

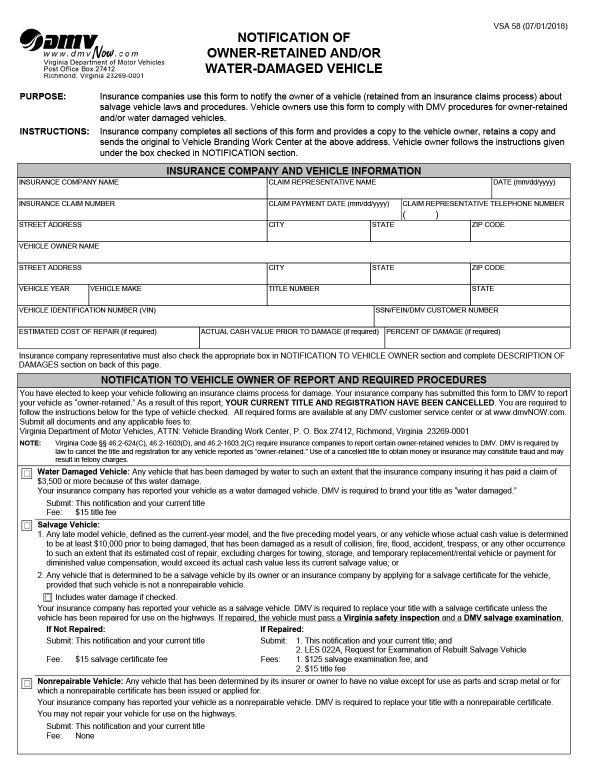

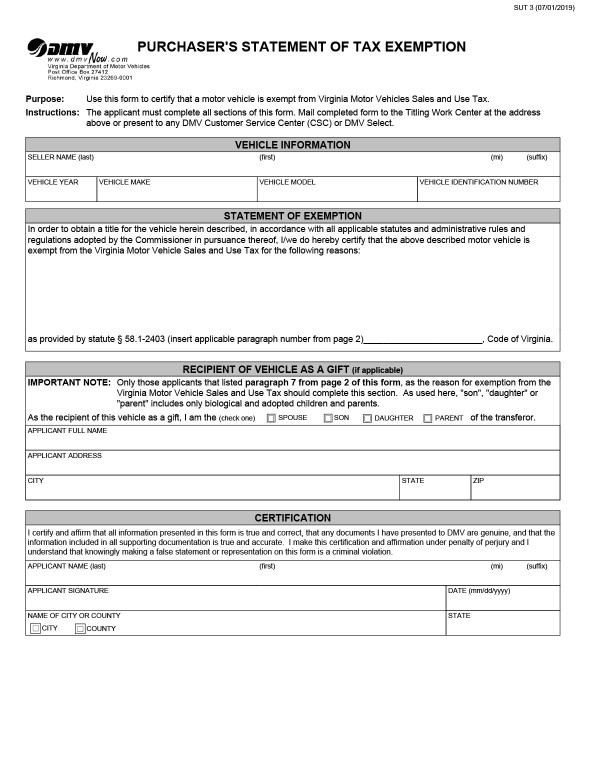

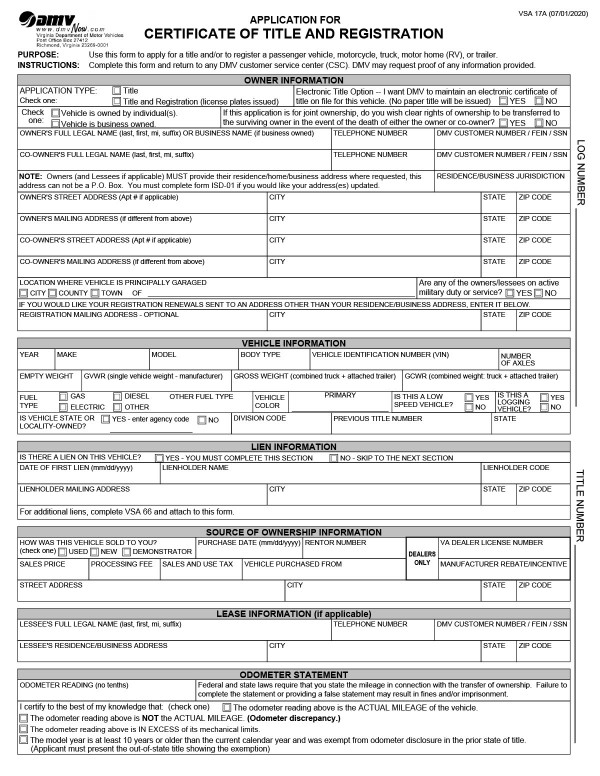

Bills Of Sale In Virginia Important Facts And Requirements

2022 Subaru Legacy For Sale In Richmond Va Hyman Bros Automobiles

Bills Of Sale In Virginia Important Facts And Requirements

Business License Tax City Of Alexandria Va

5 Banbury Rd Richmond Va 23221 Realtor Com

Knights Inn Richmond At W Broad St In Richmond Va Expedia

Bills Of Sale In Virginia Important Facts And Requirements

2022 Subaru Legacy For Sale In Richmond Va Hyman Bros Automobiles

/cloudfront-us-east-1.images.arcpublishing.com/gray/QZEMW2VFEBEQDMIPNFHE3U7UC4.jpg)

Possible Tax Rate Increase In Hopewell

/cloudfront-us-east-1.images.arcpublishing.com/gray/JZ47KNNHWFH2XFPUEIDIGHZBVY.jpg)

12 On Your Side Insurance Problems With Storage Infestation

2023 Subaru Outback Incentives Specials Offers In Richmond Va